Handbook & Resources

Process Maps

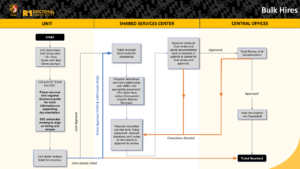

Bulk Hires

New Hires

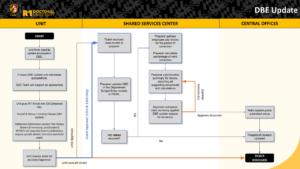

DBE Update

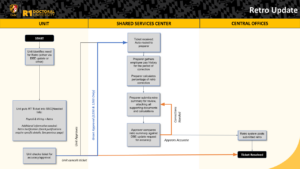

Retro Update

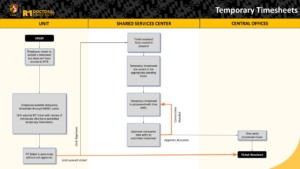

Temporary Timesheets

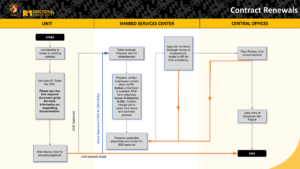

Contract Renewals

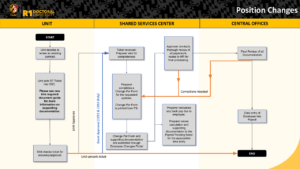

Position Changes

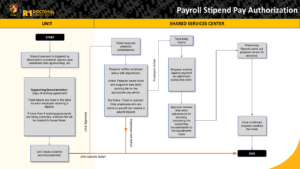

Payroll Stipend Pay Authorization

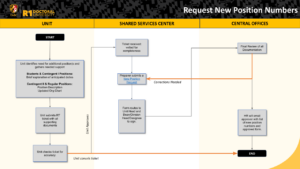

Request New Position Numbers

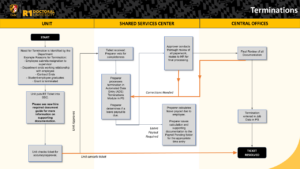

Terminations

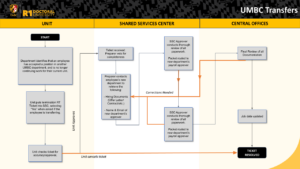

UMBC Transfers

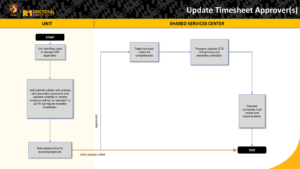

Update Timesheet Approver(s)

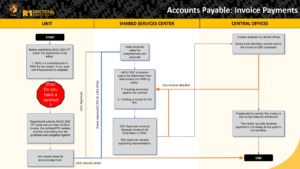

Accounts Payable: Invoice Payments

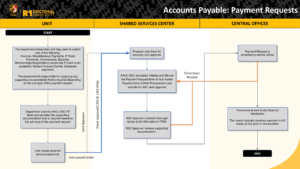

Accounts Payable: Payment Requests

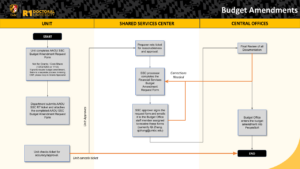

Budget Amendments

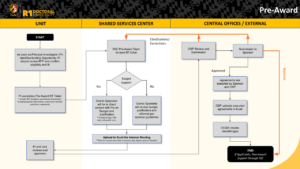

Pre-Award

Calendars

Templates & DocuSign Links

FAQs

Budgeting & Financial Management

Q: How do I create a new project?

Finance

A: Review the “AAOU SSC Journal Entry Cheat Sheet”:

Payroll & Hiring

Q: How does a timesheet approver reject an employees electronic timesheet after already approving it?

Q: Can payroll checks be held overnight?

A: All payroll checks should be placed in the mail on Friday afternoon if they were not picked up. If checks cannot be mailed on Friday afternoon, or you have staff onsite to distribute checks to employees who are scheduled to work on Saturday, the checks should be stored in a locked safe until distributed to the employee(s).

Q: How do I hire a Student Worker?

Q: How do I hire a Graduate Assistant?

Q: How do I establish a brand new position/position number?

A: Shared Services does not establish new positions/position numbers, for Exempt/Non-Exempt Regular & Contingent II positions. A request for a new position for these classifications must be submitted to HR, by following the process outlined here: https://hr.umbc.edu/compensationclassification/establishing-a-position/

Shared Services does manage existing positions, assign position numbers to new hires, and when necessary will establish or reclassify a position based on the department’s needs, for the following position classifications:

- Faculty

- Graduate Assistant

- Student

- Contingent I

Purchasing

Q: Do I need to submit a quote for a purchase?

A: All purchases requiring a Purchase Order should be submitted with a quote before receiving Goods or Services.

Grants

Understanding Grants – Process & Procedure

Navigating the world of grants can be complex, but UMBC is here to support its faculty and staff every step of the way. These resources provide a succinct overview of the pre-award and post-award processes, including key information on allowable costs, indirect cost waivers, and helpful resources.

Pre-Award

Pre-Award Support: Getting Your Grant Ready

This section covers the essential steps and considerations before your grant is officially awarded.

What are Grants?

Grants at UMBC refer to external sponsored awards for research, instruction, or public service. These funds come from outside sources (federal, state, private) under a legal agreement and require specific adherence to regulations and guidelines.

Key Players in Pre-Award

- Office of Sponsored Programs (OSP)

The institutional office authorized to submit proposals on behalf of UMBC. OSP handles proposal submissions, negotiation and acceptance of sponsored agreements, and provides guidance on sponsor guidelines. - Provost Office Shared Services Center (POSSC)

We provide dedicated administrative and financial support to faculty and staff from various departments under the Provost’s purview for proposal development, budget preparation, and liaison with OSP. - Principal Investigator (PI)

The faculty or staff member leading the proposed project

Pre-Award Process Highlights and Process Flow

- Funding Opportunity Identification: Identify potential funding sources. The POSSC and OSP can assist with sponsor research.

- Consultation & Planning: Initiate discussions with the Provost Office Shared Services Center (POSSC) as early as possible. They will help discuss your vision, establish timelines, and outline required documents.

- Proposal Development

- Budget Preparation

Work with the POSSC (initiated via email and/or RT ticket) to draft a detailed budget and justification, ensuring it aligns with sponsor requirements and UMBC policies. - Required Documents

Gather all necessary documents, including the Request for Proposal (RFP), pre-award questionnaire, project summary/Statement of Work (SOW), and any institutional forms. - Subawards

If your project involves a subawardee, coordinate with the POSSC to receive and review all required documents from the subrecipient. UMBC has specific policies and forms for subawards. A key distinction:- Subrecipient: Performs substantive programmatic work, shares responsibility for programmatic decision-making, and often collaborates in proposal development.

- Vendor/Consultant: Provides routine goods or services within its normal business operations, with specified deliverables and often paid on a fixed-price basis.

- Budget Preparation

- Internal Routing (Kuali)

All proposals must be routed through UMBC’s electronic research administration tool, Kuali, for internal approvals from departments, centers, and OSP. Sufficient lead time is crucial for this process. Every submission requires at least 3 business days, so we will work towards ample time for the submission to be reviewed by OSP. - Compliance

Ensure all proposal documents comply with the Uniform Guidance, and is in line with institutional, funding agency, and federal regulations. This includes completing Financial Conflict of Interest (COI) forms and PI eligibility procedures. - Submission

OSP is the authorized office for final proposal submission to the sponsor.

Allowable Costs (Pre-Award Considerations)

When developing your budget, ensure all proposed costs meet the following four tests of allowability under Uniform Guidance (RACC):

- Reasonable: The cost is what a prudent person would incur under the circumstances and is necessary for the project.

- Allocable: The cost directly benefits the sponsored agreement.

- Consistent Treatment: Costs incurred for the same purpose in like circumstances are treated consistently as either direct or indirect costs across all activities.

- Conforms to Limitations: The cost adheres to any limitations or exclusions set forth in Uniform Guidance or the sponsored agreement.

No-Indirect Cost Waivers (Facilities & Administrative Costs – F&A)

Indirect Costs are also synonymous to the term ‘F&A’ at UMBC. We generally require the application of the full federally negotiated F&A cost rate on all sponsored project proposals. However, waivers may be considered under limited conditions.

- Sponsor Policy Limitation – if the sponsoring agency (federal, state, or private) has a published written policy that limits or excludes F&A costs, a waiver is not required; simply upload the policy to Kuali.

- New and/or Established Investigator in New Field – for proposals designed to initiate a new investigator or an established investigator in a new research area, a reduction or elimination of F&A may be considered to preserve direct cost expenditures. These are typically limited in duration and scope, aiming to foster future funding with full F&A recovery.

- Process: An F&A Cost Waiver Request DocuSign form is available on the OSP website. It’s recommended to start the Kuali proposal but not route it for signatures until the waiver is reviewed and approved by OSP and ORCA. The finalized waiver must then be attached to the Kuali proposal. https://research.umbc.edu/forms-for-grants-contracts/

Navigating Gray Areas (Pre-Award)

- Preliminary Proposals/White Papers: Our office can assist with determining if pre-award involvement (routing through OSP) is needed based on whether the sponsor requires a budget and/or a signature. Refer to OSP’s Pre-proposal Policy.

- Data Use Agreements (DUAs): DUAs must be routed through OSP as an Unfunded Agreement, like a traditional funding proposal, including a specific DUA questionnaire in Kuali.

- Cost Sharing: If cost sharing (matching) is required or voluntarily committed in the proposal, it becomes a binding obligation. All proposed mandatory and voluntary committed cost sharing must be recorded, tracked, and reported. Allowable cost-sharing generally adheres to the same allowability principles as direct costs.

For further assistance and detailed information, please refer to the following UMBC resources:

- Provost Office Shared Services Center (POSSC): Derek Prouty (derekprouty@umbc.edu, 410-455-3670)

- Office of Sponsored Programs (OSP): https://research.umbc.edu/office-of-sponsored-programs-2/ (Pre-award, non-financial post-award, policies, forms)

Office of Contract and Grant Accounting (OCGA): https://cga.umbc.edu/ (Financial post-award, allowable/unallowable costs, policies)

Post-Award

Post-Award Support

This section focuses on the administrative and financial management of your grant once it has been awarded.

Key Players in Post-Award

- Office of Contract and Grant Accounting (OCGA)

OCGA is responsible for the financial post-award activities of UMBC’s restricted funds. This includes award setup, compliance review, revenue collection, invoicing, financial reporting, and audit responses. OCGA interprets agency policies and ensures adherence to regulations and UMBC procedures. - Office of Sponsored Programs (OSP)

OSP continues to be involved in non-financial post-award functions, such as award modifications, subrecipient monitoring, and non-financial closeout of awards. - Provost Office Shared Services Center (POSSC)

This unit provides ongoing assistance with budgetary accounting, monthly monitoring, projections, personnel management (recruiting, hiring, payroll), procurement of supplies/equipment, subaward processing, and liaising with OSP and OCGA. If the department is not under the SSC, we will still be able to assist with projections. - Principal Investigator (PI)

Responsible for the technical execution of the project and ensuring expenditures align with the approved budget and sponsor terms.

Post-Award Process Highlights

- Award Setup: OCGA sets up the award in PeopleSoft and conducts an initial review to ensure it reflects the awarded budget and terms. A chartstring will be created by OCGA based on what the award is (cost-share / restricted sponsored funds).

- Financial Management & Monitoring

- Budget Management: Work closely with the Provost Office Shared Services Center (POSSC) for ongoing budget monitoring and projections. We will be able to provide monthly reconciliations to the PI and schedule monthly meetings to ensure compliance, plans, and model the projections closer to the expected.

- Expenditure: Ensure all expenditures are allowable, allocable, and consistent with the award terms and Uniform Guidance.

- Cost Transfers: Understand the procedures for transferring costs between accounts, which should be done promptly and with proper justification.

- Effort Reporting: Faculty paid from grants are required to certify their effort expended on sponsored projects. The POSSC can assist with this.

- Allowable Costs (Post-Award Application):

- Reinforce the four tests of allowability (reasonable, allocable, consistent, conforms to limitations).

- Common Examples: Salaries, fringe benefits, equipment, supplies, travel, subaward costs, and publications directly related to the project are generally allowable.

- Unallowable Costs (Federal Grants): Certain costs are generally unallowable on federal awards. This includes, but is not limited to:

- Advertising for general promotion of the University (e.g., promotional items, gifts).

- Alcoholic beverages.

- Entertainment costs.

- Fines and penalties.

- Faculty and exempt staff salary in excess of base rates (unless explicitly approved by the sponsor).

- Cost overruns from other sponsored agreements.

- Costs allocable to industry or foreign government-sponsored activities cannot be shifted to federally sponsored agreements.

- These costs cannot be charged to a sponsored award as direct or indirect costs. Separate account codes exist in PeopleSoft to track them.

- Modifications & Changes:

- No-Cost Extensions (NCEs): If more time is needed to complete the project without additional funds, PIs can request a no-cost extension through OSP.

- Budget Revisions: Changes to the approved budget may require sponsor approval and routing through OSP.

- Personnel Changes: Changes in key personnel may require sponsor notification or approval.

- Reporting:

- Fiscal Reporting: OCGA is responsible for submitting financial reports to sponsors.

- Performance Reports (RPPR): PIs are responsible for submitting research performance progress reports (RPPR) to the sponsor, often with assistance from the POSSC.

- Closeout: As the project nears its end, OSP manages non-financial closeout activities, while OCGA handles financial closeout, ensuring all expenditures are reconciled and final reports are submitted. This includes managing non-cancellable obligations if an award is terminated.

- Record Retention: Maintain all sponsored project records according to UMBC and sponsor requirements.

Navigating Gray Areas (Post-Award):

- Cost Transfers: Be prepared to provide clear and thorough documentation and justification for any cost transfers, as these are closely scrutinized during audits.

- Unused Leave Payout: Be aware of policies regarding payout for unused annual leave, especially for faculty with Sponsored Research Appointments, as sponsor policies may dictate allowability.

- Subrecipient Monitoring: Ensure subrecipients are adhering to the terms of their subaward and provide timely reports and invoices.

- Audit Responses: OCGA leads responses to audits related to sponsored projects.

For further assistance and detailed information, please refer to the following UMBC resources:

- Provost Office Shared Services Center (POSSC): Derek Prouty (derekprouty@umbc.edu, 410-455-3670)

- Office of Sponsored Programs (OSP): https://research.umbc.edu/office-of-sponsored-programs-2/ (Pre-award, non-financial post-award, policies, forms)

Office of Contract and Grant Accounting (OCGA): https://cga.umbc.edu/ (Financial post-award, allowable/unallowable costs, policies)

Quick Links

Central Offices

SSC Forms and Reference Materials