As we continue to function in a hybrid environment, please read this page in its entirety to ensure your paperwork is accurate and processed timely.

First Step:

Your new hire paperwork will come via DocuSign as two separate emails from UMBC Human Resources (HR) (dshr@umbc.edu). Please check your inbox and spam folder for these emails.

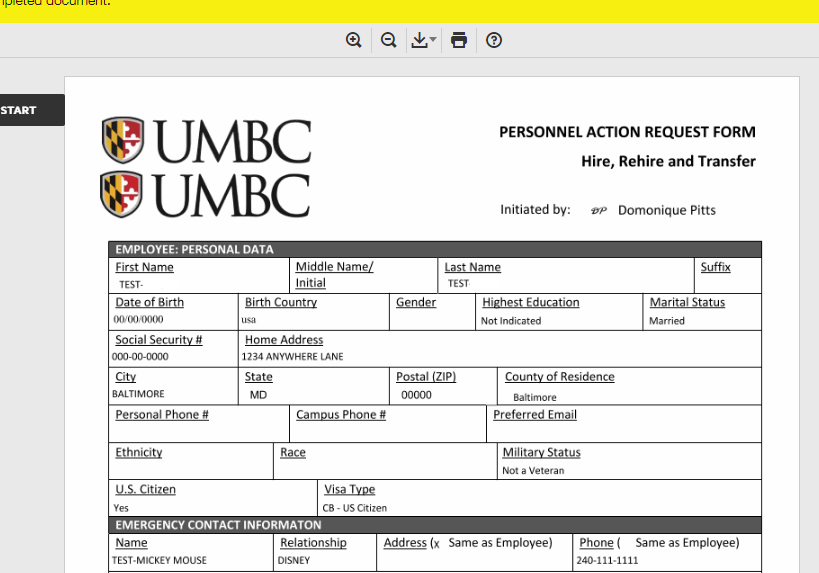

One will be for your New Hire information

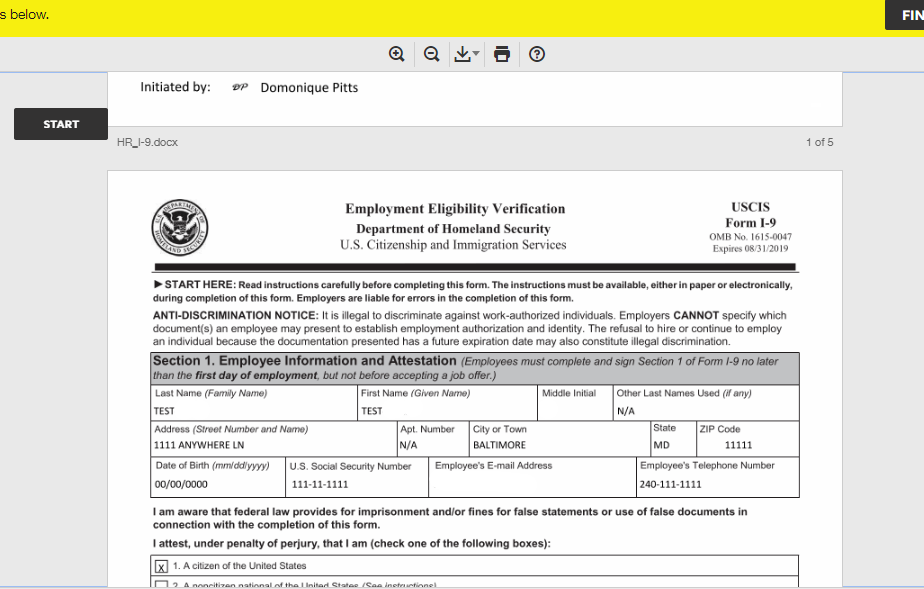

Another for your I-9

I-9 NOTE: You will need to submit either one (1) item from List A OR one (1) item from List B AND List C.

*You will need to physically bring in your forms of identification for your I-9 to complete your hiring packet. An Authorized Representative from your hiring department will contact you to schedule you in-person I-9 verification appointment.*

The in-person review of your I-9 documents must be completed by or before your start date.

*Note* If you are an NRA, you will receive further information from AAOU SSC

Second Step:

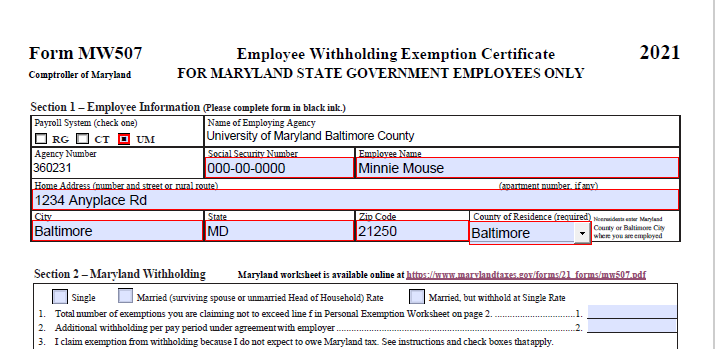

Complete the fillable W-4, MW507, and Direct Deposit forms.

Please take your time and it is best to inquire with guardians or a financial advisor if you have any questions regarding your tax forms.

*If you fail to submit these forms or your paperwork is incorrect, you will be taxed at the highest amount.*

Please mail in your completed forms directly to:

Central Payroll Bureau

P.O. Box 2396

Annapolis, MD 21404

Things to consider:

- Fill out all forms electronically, print, and sign with ink

- If a mistake is made, complete a fresh form.

- On the W-4, if you work somewhere else on campus you DO NOT need to fill in Step 2: Multiple Jobs, as this is under the same employer. In most student cases, you will just fill in Steps 1 and 5.

- NOTICE: it is COUNTY of residence, not country. 🙂 If you live out of state, this will be Baltimore on the MW 507.

- On the MW-507, if you fill anything for Line #1 (exemptions) you cannot fill in Exempt anywhere else on the form. If one of the exemption statements applies, only fill it out on that line and nowhere else. In most cases, there will only be 1-2 lines filled. If selecting line #3, make sure to check off both boxes (long as they apply,) write the year 2021 on the small line and Exempt on the right-hand side.